AGENDA

General Meeting

Wednesday, 19 June 2024

commencing at 9:30am

The Council Chambers

91 - 93 Bloomfield Street

CLEVELAND QLD

AGENDA

General Meeting

Wednesday, 19 June 2024

commencing at 9:30am

The Council Chambers

91 - 93 Bloomfield Street

CLEVELAND QLD

General Meeting Agenda 19 June 2024

2 Record of Attendance and Leave of Absence

5 Receipt and Confirmation of Minutes

6 Declaration of Prescribed Conflict of Interests and Declarable Conflict of Interests

7 Matters Outstanding from Previous Council Meetings

10 Petitions and Presentations

10.2 Petition - Cr Shane Rendalls - Request for Macleay Island E-Bike Storage Facility

10.3 Petition - Cr Peter Mitchell - Request for Infrastructure Updates to Sunshine Drive, Cleveland

11 Motion to Alter the Order of Business

12 Reports from the Office of the CEO

13 Reports from Organisational Services

13.1 May 2024 Monthly Financial Report

13.2 Queensland Audit Office Interim Management Report 2023-2024

13.4 Operational Plan Quarterly Performance Report March 2024

13.5 Business Continuity Management Policy

13.6 Redheart Pty Ltd - Non Trading Company Closure.

14 Reports from Advocacy, Major Projects and Economic Development

15 Reports from Community & Customer Services.

15.1 Creative Arts Service Strategic Plan 2024-2029.

15.2 Adoption of RAL-003-P Boundary Fence Contribution Policy

15.3 Bayside and Redlands Transport and Mobility Study - Submission

15.4 MCU24/0005 9-11 Oaklands Street, Alexandra Hills - Affordable Housing Policy Application

15.5 01/24 - City Plan Administrative and Minor Amendment - General

16 Reports from Infrastructure & Operations

16.1 Council Update on Wellington Point Esplanade Walking Track Reinstatement

17 Notices of Intention to Repeal or Amend a Resolution

18.1 Notice of Motion - Cr Julie Talty - Naming of Trail Head

19 Urgent Business Without Notice

20.1 Voluntary Transfer of Land Concession

20.2 Rating Exemption Application

20.3 Register of Fees 2024-2025

20.4 Disposal of Land - Russell Island

20.5 Telecommunication Facility Leases

20.6 Sub-Regional Waste Alliance Materials Recovery Facility Project Update

On establishing there is a quorum, the Mayor will declare the meeting open.

Recognition of the Traditional Owners

Council acknowledges the Quandamooka people who are the traditional custodians of the land on which we meet. Council also pays respect to their elders, past and present, and extends that respect to other indigenous Australians who are present.

2 Record of Attendance and Leave of Absence

Motion is required to approve leave of absence for any Councillor absent from today’s meeting.

Member of the Ministers’ Fellowship will lead Council in a brief devotional segment.

Mayor to present any recognition of achievement items.

5 Receipt and Confirmation of Minutes

General Meeting - 15 May 2024.

6 Declaration of Prescribed Conflict of Interests and Declarable Conflict of Interests

Councillors are reminded of their responsibilities in relation to a Councillor’s Prescribed Conflict of Interest and Declarable Conflict of Interest at a meeting. For full details see Chapter 5B of the Local Government Act 2009.

In summary:

Obligation of Councillor with Prescribed Conflict of Interest

Section 150EL of the Local Government Act 2009 requires Councillors to declare a Prescribed Conflict of Interest in a matter as soon as they become aware of their interest in the matter, either:

(1) at a local government meeting, or

(2) as soon as practicable, by giving the Chief Executive Officer written notice of the prescribed conflict of interest.

(3) The declaration must include the following particulars:

(a) For a gift, loan or contract – the value of the gift, loan or contract;

(b) For an application for which a submission has been made – the matters the subject of the application and submission;

(c) The name of any entity, other than the Councillor, that has an interest in the matter;

(d) The nature of the Councillor’s relationship with the entity mentioned in (c) above;

(e) Details of the Councillor’s, and any other entity’s, interest in the matter.

Dealing with Prescribed Conflict of Interest at a Meeting

Pursuant to Section 150EM of the Local Government Act 2009, if a Councillor declares a Prescribed Conflict of Interest in a matter, the Councillor must leave the place at which the meeting is being held, including any area set aside for the public, and stay away from the place while the matter is discussed and voted on.

Obligation of Councillor with Declarable Conflict of Interest

Section 150EQ of the Local Government Act 2009 requires Councillors to declare a Declarable Conflict of Interest in a matter as soon as they become aware of their interest in the matter, either:

(1) at a local government meeting, or

(2) as soon as practicable, by giving the Chief Executive Officer written notice of the declarable conflict of interest.

(3) The declaration must include the following particulars:

(a) The nature of the declarable conflict of interest;

(b) If the declarable conflict of interest arises because of the councillor’s relationship with a related party:

(i) The name of the related party; and

(ii) The nature of the relationship of the related party to the Councillor; and

(iii) The nature of the related party’s interests in the matter;

(c) If the Councillor’s or related party’s personal interests arise because of the receipt of a gift or loan from another person:

(i) The name of the other person; and

(ii) The nature of the relationship of the other person to the Councillor or related party; and

(iii) The nature of the other person’s interests in the matter; and

(iv) The value of the gift or loan, and the date the gift was given or loan was made.

Procedure if Councillor has Declarable Conflict of Interest

Pursuant to Section 150ES of the Local Government Act 2009, eligible Councillors at the meeting must, by resolution, decide whether the Councillor who has declared the interest:

(1) May participate in a decision about the matter at the meeting, including by voting on the matter; or

(2) Must leave the place at which the meeting is being held, including any area set aside for the public, and stay away from the place while the eligible Councillors discuss and vote on the matter.

Duty to report another Councillor’s Prescribed Conflict of Interest or Declarable Conflict of Interest

Pursuant to section 150EW of the Local Government Act 2009, a Councillor who reasonably believes or reasonably suspects another Councillor has a Prescribed Conflict of Interest or a Declarable Conflict of Interest in a matter must:

(1) Immediately inform the person who is presiding at the meeting about the belief or suspicion; or

(2) As soon as practicable, inform the Chief Executive Officer of the belief of suspicion.

The Councillor must also inform the person presiding, or the Chief Executive Officer, of the facts and circumstances forming the basis of the belief or suspicion.

Record of Prescribed and Declarable Conflicts of Interest

Where a Councillor informs the meeting of a Prescribed or Declarable Conflict of Interest, section 150FA of the Local Government Act 2009 requires the following information to be recorded in the minutes of the meeting:

(1) The name of the Councillor who may have a prescribed or declarable conflict of interest in the matter;

(2) The particulars of the prescribed or declarable conflict of interest;

(3) If another Councillor informs the meeting of a belief of suspicion, about another Councillor’s Conflict of Interest:

(a) The action the Councillor takes;

(b) Any decision by eligible Councillors; and

(c) The name of each eligible Councillor who voted in relation to whether the Councillor has a declarable conflict of Interest, and how each eligible Councillor voted.

(4) Whether the Councillor participated in deciding the matter, or was present for deciding the matter;

(5) For a matter to which the Prescribed or Declarable Conflict of Interest relates:

(a) The name of the Councillor who has declared the conflict of interest;

(b) The nature of the personal interest, as described by the Councillor;

(c) The decision made;

(d) Whether the Councillor participated in the meeting under an approval by the Minister;

(e) If the Councillor voted on the matter, how they voted; and

(f) How the majority of Councillors voted on the matter.

(6) If the Councillor has a Declarable Conflict of Interest, in addition to the information above, the following information must be recorded in the minutes:

(a) The decision and reasons for the decision as to whether the Councillor with the Declarable Conflict of Interest may participate in the decision, or must not participate in the decision; and

(b) The name of each eligible Councillor who voted on the decision, and how the eligible Councillor voted.

7 Matters Outstanding from Previous Council Meetings

7.1 Notice of Motion - Cr Julie Talty - Report on Council's Programs Related to the Environmental Protection and Biodiversity Conservation Act

At the General Meeting 19 July 2023 (Item 18.1 refers), Council resolved as follows:

1. That Council undertakes a comprehensive report on the programs and infrastructure provision including expenditure, both operational and capital, in relation to koalas and threatened species management, and native vegetation rehabilitation and revegetation.

2. That a report be brought back to Council, and made publicly available on the Council website, explaining the success or other outcomes over the last ten years, and where known, planned in the coming five years in relation to koalas and threatened species management, and native vegetation rehabilitation and revegetation.

3. That the report be provided to the Federal Government to assist in Environmental Protection Biosecurity Conservation (EPBC) assessment of community infrastructure.

A report will be brought to a future meeting of Council.

7.2 Draft Birkdale Community Precinct Local Government Infrastructure Designation Consultation Report

At the General Meeting 13 September 2023 (Item 14.1 refers), Council resolved as follows:

1. To endorse the Birkdale Community Precinct Local Government Infrastructure Designation Consultation Summary Report, including responses to submissions.

2. To note that officers will continue to progress amendments to the Birkdale Community Precinct Local Government Infrastructure Designation based on the Consultation Report, and that a report seeking Council endorsement to make the designation will be brought to a future meeting of Council.

3. To thank the community for its participation in the consultation.

A report will be brought to a future meeting of Council.

7.3 Mayoral Minute - GOV-016-P Expenses Reimbursement and Provision of Facilities for Councillors Policy

At the General Meeting Thursday, 18 April 2024 (Item 8.1 refers), Council resolved as follows:

1. To request the Chief Executive Officer to undertake a review of the vehicle options for Councillors under GOV-016-P Expenses Reimbursement and Provision of Facilities for Councillors Policy.

2. That a report to be brought back to Council at a future General Meeting for consideration.

A report will be brought to a future meeting of Council.

In accordance with s.6.9 of Council Meeting Standing Orders, the Mayor may put to the meeting a written motion called a ‘Mayoral Minute’, on any matter. Such motion may be put to the meeting without being seconded, may be put at that stage in the meeting considered appropriate by the Mayor and once passed becomes a resolution of Council.

In accordance with s.6.10 Council Meeting Standing Orders:

1. In each meeting (other than special meetings), a period of 15 minutes may be made available by resolution to permit members of the public to address the local government on matters of public interest relating to the local government. This period may be extended by resolution.

2. Priority will be given to members of the public who make written application to the CEO no later than 4.30pm two days before the meeting. A request may also be made to the chairperson, when invited to do so, at the commencement of the public participation period of the meeting.

3. The time allocated to each speaker shall be a maximum of five minutes. The chairperson, at his/her discretion, has authority to withdraw the approval to address Council before the time period has elapsed.

4. The chairperson will consider each application on its merits and may consider any relevant matter in his/her decision to allow or disallow a person to address the local government, e.g.

a) Whether the matter is of public interest;

b) The number of people who wish to address the meeting about the same subject

c) The number of times that a person, or anyone else, has addressed the local government previously about the matter;

d) The person’s behaviour at that or a previous meeting; and

e) If the person has made a written application to address the meeting.

5. Any person invited to address the meeting must:

a) State their name and suburb, or organisation they represent and the subject they wish to speak about;

b) Stand (unless unable to do so);

c) Act and speak with decorum;

d) Be respectful and courteous; and

e) Make no comments directed at any individual Council employee, Councillor or member of the public, ensuring that all comments relate to Council as a whole.

10 Petitions and Presentations

10.1 Petition - Cr Shane Rendalls - Request for Council to Undertake a New Southern Moreton Bay Islands Alternate Transport Route Study

In accordance with s.6.11 of Council Meeting Standing Orders, Cr Shane Rendalls will present the petition and motion as follows:

|

That the petition is of an operational nature and be received and referred to the Chief Executive Officer for consideration. |

10.2 Petition - Cr Shane Rendalls - Request for Macleay Island E-Bike Storage Facility

In accordance with s.6.11 of Council Meeting Standing Orders, Cr Shane Rendalls will present the petition and motion as follows:

|

That the petition is of an operational nature and be received and referred to the Chief Executive Officer for consideration. |

10.3 Petition - Cr Peter Mitchell - Request for Infrastructure Updates to Sunshine Drive, Cleveland

In accordance with s.6.11 of Council Meeting Standing Orders, Cr Peter Mitchell will present the petition and motion as follows:

|

That the petition is of an operational nature and be received and referred to the Chief Executive Officer for consideration. |

11 Motion to Alter the Order of Business

The order of business may be altered for a particular meeting where the Councillors at that meeting pass a motion to that effect. Any motion to alter the order of business may be moved without notice.

13 Reports from Organisational Services

13.1 May 2024 Monthly Financial Report

Objective Reference: A11153010

Authorising Officer: Michael D Wilson, Acting Executive Group Manager Financial Services and Chief Financial Officer

Responsible Officer: Michael D Wilson, Acting Executive Group Manager Financial Services and Chief Financial Officer

Report Author: Udaya Panambala Arachchilage, Corporate Financial Reporting Manager

Attachments: 1. May 2024 Monthly Financial Report ⇩

Purpose

To note the year to date financial results as at 31 May 2024.

Background

Council adopts an annual budget and then reports on performance against the budget on a monthly basis. This is not only a legislative requirement but enables the organisation to periodically review its financial performance and position and respond to changes in community requirements, market forces or other outside influences.

Interim audit 2023-2024

During May 2024 Queensland Audit Office, conducted the 2023-2024 interim audit. This visit affords the opportunity to test the effectiveness of the key controls identified in the audit planning phase of the audit, to review transactions accounted for in the statement of comprehensive income for the period from 1 July 2023 to 30 April 2024, and to review and provide feedback over proforma financial statements. The interim management report will be reviewed as part of the 2023-2024 year-end audit.

Estimated Statement of Financial Position 2023-2024

Council officers are currently preparing the Statement of Estimated Financial Position 2023-2024 to be tabled at the Special Budget Meeting. The Statement of Estimated Financial Position is based on Council’s actual financial position (as at 30 April 2024) and projected financial results for the months of May and June 2024.

Development of Budget 2024-2025

Council officers are currently compiling submissions for the 2024-2025 annual budget.

The Executive Leadership Team reviews the progress of the capital program on a regular basis. Council’s capital works expenditure is below budget by $4.05M due to timing of works for a number of infrastructure projects. The program is frequently and actively reprioritised and managed to ensure that projects continue to be delivered on behalf of the community. Council is on track to deliver the largest annual capital expenditure program to date.

Strategic Implications

Council has either achieved or favourably exceeded the following key financial sustainability ratios as at the end of May 2024.

· Operating Surplus Ratio

· Operating Cash Ratio

· Unrestricted Cash Expense Cover Ratio

· Asset Sustainability Ratio

· Asset Consumption Ratio

· Leverage Ratio

· Net Financial Liabilities Ratio

The Council-Controlled Revenue, Population Growth, and Asset Renewal Funding Ratios are reported for contextual purposes only. Population Growth and Asset Renewal Funding Ratios will not materially change from month to month.

Legislative Requirements

The May 2024 financial report is presented in accordance with the legislative requirement of section 204(2) of the Local Government Regulation 2012, requiring the Chief Executive Officer to present the financial report to a monthly Council meeting.

Risk Management

The May 2024 financial report has been noted by the Executive Leadership Team and relevant officers who can provide further clarification and advice around actual to budget variances.

Financial

There is no direct financial impact to Council as a result of this report, however it provides an indication of financial outcomes at the end of May 2024.

People

Nil impact expected as the purpose of the attached report is to provide financial information to Council based upon actual versus budgeted financial activity.

Environmental

Nil impact expected as the purpose of the attached report is to provide financial information to Council based upon actual versus budgeted financial activity.

Social

Nil impact expected as the purpose of the attached report is to provide financial information to Council based upon actual versus budgeted financial activity.

Human Rights

There are no human rights implications from this report as the purpose of the attached report is to provide financial information to Council based upon actual versus budgeted financial activity.

Alignment with Council's Policy and Plans

This report has a relationship with the following items of Council’s Our Future Redlands – A Corporate Plan to 2026 and Beyond:

Efficient and effective organisation objectives

7.1 Improve the efficiency and effectiveness of Council’s service delivery to decrease costs, and enhance customer experience and community outcomes.

7.4 Demonstrate good governance through transparent, accountable processes and sustainable practices and asset management.

Consultation

|

Consulted |

Date |

Comment |

|

Council departmental officers |

Year to date 31 May 2024 |

Consulted on financial results and outcomes |

|

Financial Services Group officers |

Year to date 31 May 2024 |

Consulted on financial results and outcomes |

|

Executive Leadership Team and Senior Leadership Team |

Year to date 31 May 2024 |

Recipients of variance analysis between actual and budget. Consulted as required |

Options

Option One

That Council resolves to note the financial position, results and ratios for May 2024 as presented in the attached Monthly Financial Report.

Option Two

That Council resolves to request additional information.

|

That Council resolves to note the financial position, results and ratios for May 2024 as presented in the attached Monthly Financial Report. |

13.2 Queensland Audit Office Interim Management Report 2023-2024

Objective Reference: A11194100

Authorising Officer: Amanda Pafumi, General Manager Organisational Services

Responsible Officer: Michael D Wilson, Acting Executive Group Manager Financial Services and Chief Financial Officer

Report Author: Aneta Zimon-Killoran, Service Manager Corporate Finance

Udaya Panambala Arachchilage, Corporate Financial Reporting Manager

Attachments: 1. Queensland Audit Office Interim Management Report 2023-2024 ⇩

Purpose

To present the Queensland Audit Office (QAO) interim management report for 2023-2024 to Council in compliance with section 213 of the Local Government Regulation 2012.

Background

The QAO conducted an interim audit to test the effectiveness of the key controls identified in the audit planning phase, to review transactions accounted for in the statement of comprehensive income for the period from 1 July 2023 to 30 April 2024, and to review and provide feedback over proforma financial statements. Based on the results of the interim audit, Council’s overall internal control framework has been assessed as operating effectively.

QAO will continue the controls testing for the intervening period until 30 June 2024 and will provide Council with a management update at the completion of the final audit visit that is scheduled to commence mid-August 2024.

Issues

The final interim management report was received on 13 June 2024 and in compliance with legislation, is scheduled for presentation to Council at the 19 June 2024 General Meeting.

Strategic Implications

Legislative Requirements

Section 213 of the Local Government Regulation 2012 requires the Mayor to present a copy of the Auditor-General’s observation report at the next ordinary meeting of Local Government following receipt of the Auditor-General’s report.

Financial Services tables the report to ensure compliance with legislation, noting coordination of the prior years’ corrective actions and improvements will be undertaken by Council’s Internal Audit.

Risk Management

Risk management is undertaken during the year with respect to the internal control environment and procedures.

Financial

There are no additional financial implications arising from this QAO interim management report.

People

No impact as the purpose of the report is to present the QAO 2023-2024 interim management report.

Environmental

No impact as the purpose of the report is to present the QAO 2023-2024 interim management report.

Social

No impact as the purpose of the report is to present the QAO 2023-2024 interim management report.

Human Rights

No impact as the purpose of the report is to present the QAO 2023-2024 interim management report.

Alignment with Council's Policy and Plans

This report has a relationship with the following items of Council’s Our Future Redlands – A Corporate Plan to 2026 and Beyond:

Efficient and effective organisation objectives

7.1 Improve the efficiency and effectiveness of Council’s service delivery to decrease costs, and enhance customer experience and community outcomes.

7.4 Demonstrate good governance through transparent, accountable processes and sustainable practices and asset management.

Consultation

|

Consultation Date |

Comments/Actions |

|

|

Queensland Audit Office Representatives, General Manager Organisational Services, Acting Executive Group Manager & Chief Financial Officer, Acting Financial Controller, Chief Procurement Officer, Procurement Governance Manager, Service Manager Corporate Finance, Corporate Financial Reporting Manager. |

May-June 2024 |

Discussion of interim audit findings and agreed action moving forward for the final audit later in the calendar year. |

Options

Option One

That Council resolves to note the content in the Queensland Audit Office interim management report (referred to as the Auditor-General’s observation report in the Local Government Regulation 2012) for 2023-2024.

Option Two

That Council requests additional information.

|

That Council resolves to note the content in the Queensland Audit Office interim management report (referred to as the Auditor-General’s observation report in the Local Government Regulation 2012) for 2023-2024.

|

13.3 Revenue Policy, Investment Policy, Application of Dividends and Tax Equivalent Payments Policy, Constrained Cash Reserves Administrative Directive, Concealed Leaks Policy and Financial Hardship Policy

Objective Reference: A11120772

Authorising Officer: Peter Paterson, Acting Executive Group Manager Financial Services & Chief Financial Officer

Responsible Officer: Peter Paterson, Acting Executive Group Manager Financial Services & Chief Financial Officer

Report Author: Katharine Bremner, Budget & Systems Manager

Michael D Wilson, Service Manager Financial Planning

Attachments: 1. FIN-017-P Revenue Policy ⇩

2. FIN-001-P Investment Policy ⇩

3. FIN-005-P Application of Dividends and Tax Equivalent Payments Policy ⇩

4. FIN-007-A Constrained Cash Reserves Administrative Directive ⇩

5. FIN-018-P Concealed Leaks Policy ⇩

6. FIN-004-P Financial Hardship Policy ⇩

Purpose

To seek adoption of the Revenue, Investment, Application of Dividends and Tax Equivalent Payments, Concealed Leaks and Financial Hardship Policies, and the noting of the Constrained Cash Reserves Administrative Directive, which have been reviewed in line with the budget development for Council’s 2024-2025 annual budget.

Background

Council reviewed the attached 2024-2025 policies and administrative directive on 11 April 2024 as part of a budget development workshop for the 2024-2025 annual budget. This followed an earlier review of the Financial Strategy and related policy positions in November and December 2023 as part of Council’s Annual Review of the Financial Strategy.

Issues

The policy intent remains unchanged for all documents as discussed during the April 2024 workshop.

The Revenue Policy is reviewed annually in sufficient time to allow for the adoption of the annual budget, which is consistent with the policy.

Council’s Investment Policy outlines Council’s investment objectives, overall risk philosophy and procedures for achieving the investment goals stated in the policy. Surplus funds can either be invested or utilised to accelerate debt reduction (with possible early repayment penalties) or a combination of the two approaches.

Council receives dividends and tax equivalent payments from its commercial business activities (namely City Water and City Waste). All financial returns to Council will be applied to the provision of a community benefit.

Council continues to document its position on constrained cash reserves to demonstrate accountability and transparency to the community on cash balances that are constrained for a particular purpose.

Concealed leaks and financial hardship are two areas in which Council is committed to supporting the property owners and ratepayers of Redland City.

Strategic Implications

Legislative Requirements

Section 193 of the Local Government Regulation 2012 requires a local government’s revenue policy to be reviewed annually and in sufficient time to allow an annual budget to be adopted for the next financial year. In accordance with section 193(1)(a) of the Local Government Regulation 2012 (Regulation), the Revenue Policy outlines the principles Council intends to apply in a financial year for:

· Levying of rates and charges

· Granting concessions for rates and charges

· Recovering overdue rates and charges

· Cost-recovery methods

Further, pursuant to sections 193(1)(b) and (c) of the Regulation, the Revenue Policy also states the purpose of the concessions, and the extent to which physical and social infrastructure costs for new development are funded by charges for the development.

Section 104(5) of the Local Government Act 2009 and section 191 of the Local Government Regulation 2012 require a Local Government to have and adopt an investment policy and a revenue policy as part of its financial management system. In accordance with section 104(6) of the Local Government Act 2009, Council reviews and updates its key financial policies at each annual budget development cycle. Under Section 191 of the Local Government Regulation 2012, an investment policy is required to outline a local government’s investment objectives and its overall risk philosophy and procedures for achieving the goals related to investment stated in the policy.

The South East Queensland Customer Water and Wastewater Code requires distributor-retailers and withdrawn councils to have a concealed leaks policy and a financial hardship policy.

Risk Management

Council’s Long Term Financial Strategy discloses risks, issues and mitigation strategies aligned to the investment of surplus funds, revenues and pricing, expenditures and cash balances influencing the reserve balances and associated movements in reserves.

Additionally, the Financial Services Group regularly reviews its risk register to ensure policies and practices are current and responsive to corporate revenue risks and that no material risks are identified with respect to managing Council’s investments.

Council reports full details of its reserve balances and movements on a monthly basis to monitor reserve usage and also provide the community with transparency.

Council receives revenue streams from its commercial business activities in accordance with the Local Government Tax Equivalents Regime and may also receive dividends and other returns from investments in associates, subordinates or other entities.

Financial

There are no direct financial impacts to Council resulting from this report although it contains revised policy positions that property owners may draw on in the future as outlined above.

The financial implications and intent contained within the attached Revenue Policy, Concealed Leaks Policy and Financial Hardship Policy have been workshopped with Councillors and the Executive Leadership Team.

The 2024-2025 Investment Policy continues to include options for investing in commercial opportunities, joint ventures, associates, and subsidiaries in the future. Prior to investment, a comprehensive analysis will be undertaken to ensure the benefits of the investment outweigh the risks and costs. The analysis will ensure any proposal for investment outside a financial institution/fund manager will maintain or improve all relevant financial ratios and measures of sustainability within the adopted Financial Strategy targets. Any investment outside of a financial institution/fund manager must also be consistent with the principles and objectives contained in Council’s Revenue and Dividend Policies.

Reserve movements are transfers in community equity and only constrain cash for particular works that feature in annual or long-term operational or capital programs.

People

Nil impact expected.

Environmental

Nil impact expected.

Social

Nil impact expected.

Human Rights

Nil impact expected.

Alignment with Council's Policy and Plans

This report and the attached documents align with Council’s Corporate Plan: Our Future Redlands – A Corporate Plan to 2026 and Beyond. In particular, the attachments underpin objective 7.4 Demonstrate good governance through transparent, accountable processes and sustainable practises and asset management.

Consultation

|

Consulted |

Consultation Date |

Comments/Actions |

|

General Counsel Group |

May 2024 |

Report and attachments reviewed for compliance with legislation |

|

Finance Officers, Councillors and Executive Leadership Team |

11 April 2024 |

2024-2025 Budget Workshop – opportunity to review and amend the policies and administrative directive |

|

Financial Services Group Officers |

March 2024 |

Review of current financial policies and administrative directive documents |

|

Finance Officers, Councillors and Executive Leadership Team |

19 November 2023 12 December 2023 |

Annual Financial Strategy Workshops – opportunity to review and amend the policies and administrative directive |

Options

Option One

That Council resolves as follows:

1. To adopt the policies in Attachments 1, 2 and 3 of the report for 2024-2025:

a) FIN-017-P Revenue Policy

b) FIN-001-P Investment Policy

c) FIN-005-P Application of Dividends and Tax Equivalent Payments Policy

2. To note FIN-007-A in Attachment 4 Constrained Cash Reserves Administrative Directive.

3. To adopt the policies in Attachments 5 and 6 of the report:

a) FIN-018-P Concealed Leaks Policy

b) FIN-004-P Financial Hardship Policy

Option Two

That Council resolves to request additional information or amendments to the attached prior to adoption.

|

That Council resolves as follows: 1. To adopt the policies in Attachments 1, 2 and 3 of the report for 2024-2025: a) FIN-017-P Revenue Policy b) FIN-001-P Investment Policy c) FIN-005-P Application of Dividends and Tax Equivalent Payments Policy 2. To note FIN-007-A in Attachment 4 Constrained Cash Reserves Administrative Directive. 3. To adopt the policies in Attachments 5 and 6 of the report: a) FIN-018-P Concealed Leaks Policy b) FIN-004-P Financial Hardship Policy

|

13.4 Operational Plan Quarterly Performance Report March 2024

Objective Reference: A11095561

Authorising Officer: Amanda Pafumi, General Manager Organisational Services

Responsible Officer: Tony Beynon, Group Manager Corporate Governance

Report Author: Daniella Busk, Acting Adviser Operational Planning & Performance

Attachments: 1. Operational Plan Quarterly Performance Report January to March 2024, Quarter Three ⇩

Purpose

To provide an update on the progress of the Operational Plan 2023-2024 for Quarter Three from 1 January to 31 March 2024.

Background

The Local Government Act 2009 requires Council to adopt an operational plan each year. The Operational Plan 2023-2024 (the Plan) is an important planning document which sets out how Council intends to implement the Corporate Plan Our Future Redlands – A Corporate Plan to 2026 and Beyond.

The Plan is structured to reflect the seven goals (themes) of the Corporate Plan, and outlines activities that Council plans to deliver to progress the 30 Catalyst Projects and 37 Key Initiatives in the 2023-2024 financial year.

The Local Government Regulation 2012 requires the Chief Executive Officer to present a written assessment of Council’s progress towards implementing the annual Operational Plan at meetings of Council, at least quarterly.

Issues

The Operational Plan 2023-2024 Performance Report (Attachment 1) focusses on Council’s performance from 1 January to 31 March 2024. It includes a progress and status update for each activity for Catalyst Projects and Key Initiatives outlined in the Plan.

The report provides commentary by exception on activities that are not 100% complete in Quarter Three. In addition, the report provides Key Activities and Highlights under each goal (theme) of the Corporate Plan.

The following summarises the status of the 67 Catalyst Projects and Key Initiatives outlined in the Operational Plan 2023 – 2024 as of 31 March 2024:

|

On Track |

56 |

|

Monitor |

6 |

|

Concern |

1 |

|

Completed |

4 |

|

Cancelled |

0 |

|

Total |

67 |

The four Catalyst Projects and Key Initiatives finalised by Council in the Operational Plan 2023 – 2024 are as follows:

· Catalyst Project 3.3 New City Entry Statement.

· Catalyst Project 4.4 Minjerribah Panorama Coastal Walk.

· Catalyst Project 5.3 Marine Public Transport Facility Program.

· Key Initiative 7.3 Improve our value for money delivery through the upgrade of our financial management system.

The following summarises the status of the 70 activities outlined in the Operational Plan 2023 – 2024 as of 31 March 2024:

|

On Track |

57 |

|

Monitor |

7 |

|

Concern |

1 |

|

Completed |

5 |

|

Cancelled |

0 |

|

Total |

70 |

Strategic Implications

Legislative Requirements

This report has been prepared in compliance with section 174(3) of the Local Government Regulation 2012 which states that ‘The chief executive officer must present a written assessment of the local government’s progress towards implementing the annual operational plan at meetings of the local government held at regular intervals of not more than 3 months’.

Risk Management

The risk of not delivering the Plan is that Council does not achieve the commitments set out in the longer-term Corporate Plan. Each activity has associated risks which are managed by the relevant area of Council.

Financial

The Plan is funded by the 2023-2024 Annual Budget adopted by Council on 26 June 2023.

People

Although delivery of the Plan itself is dependent on staff resources, there are no direct impacts on people resulting from this report.

Environmental

Some activities within the Plan directly contribute to Council’s environmental commitments. However, this report does not have any direct environmental impacts.

Social

Some activities within the Plan directly contribute to Council’s social commitment. However, this report does not have any direct social impacts.

Human Rights

There are no human rights implications associated with this report.

Alignment with Council's Policy and Plans

This performance report is in response to Council’s Operational Plan 2023-2024. The Plan outlines activities against the seven goals (themes) in the Corporate Plan that Council plans to deliver in 2023-2024. As such, it is a key planning document and consistent with Council’s current Corporate Plan Our Future Redlands – A Corporate Plan to 2026 and Beyond.

Council adopted its Corporate Plan on 16 December 2020, for commencement on 1 July 2021. The Corporate Plan provides Council with a framework for forward planning and future delivery of services and infrastructure.

Consultation

|

Consulted |

Consultation Date |

Comments/Actions |

|

Executive Group Manager People, Culture and Organisational Performance General Manager Organisational Services, General Manager Community and Customer Services General Manager Infrastructure and Operations General Manager Advocacy, Major Projects and Economic Development |

April 2024 |

The activity progress and comments have been provided by the officers involved in delivering the activities within the Operational Plan 2023-2024. |

Options

Option One

That Council resolves to note the Operational Plan 2023-2024 Performance Report for Quarter Three from 1 January to 31 March 2024, at Attachment 1.

Option Two

That Council resolves to note this report and request additional information.

|

That Council resolves to note the Operational Plan 2023-2024 Performance Report for Quarter Three from 1 January to 31 March 2024, at Attachment 1. |

13.5 Business Continuity Management Policy

Objective Reference: A8263102

Authorising Officer: Amanda Pafumi, General Manager Organisational Services

Responsible Officer: Amanda Pafumi, General Manager Organisational Services

Report Author: Andrew Ross, Executive Group Manager Risk & Legal Services

Attachments: 1. RAL-004-P Business Continuity Management Policy ⇩

Purpose

To review and approve the new Business Continuity Management Policy as attached.

Background

The Business Continuity Management Policy (BCMP) strengthens Council’s approach to business continuity and risk management to plan, respond and recover from events that may disrupt Council operations and services.

The identification and management of risks is outlined in the Enterprise Risk Management Framework and forms part of Council’s obligations under the Local Government Regulation 2012, section 175 (1) (b) (ii) to manage operational risks.

Whilst the Enterprise Risk Management Framework outlines Council’s broad approach to managing risk, a separate BCMP focuses on restoring critical business functions and minimising the impact of disruptive events on the operations and objectives of Council leading to improved resilience and response capabilities. The policy confirms Council’s commitment to:

· Ensuring key critical business functions are restored and maintained as soon as possible.

· Minimising the impact of disruptive events on the operations and objectives of Council.

· Minimising any impacts to the delivery of services to the community.

· Ensuring timely return to normal operational activities.

· Managing employee fatigue.

· Informative and timely communication to employees and the community.

· Business Continuity Plan and Business Recovery Plan testing.

· Continuously improving resilience and response capabilities for critical business functions.

· An integrated approach for risk management, disaster management and business continuity management.

The Policy strengthens strategic direction to support the existing Business Continuity Plan (BCP) and Business Recovery Plans (BRPs).

The Policy is overseen by the Operational Risk Management Committee (ORMC) and the Audit and Risk Management Committee (ARMC).

Strategic Implications

Legislative Requirements

The Policy is aligned to Local Government Regulation 2012, section 175 (1) (b) (ii) to manage operational risks; and Australian Standard AS/NZS ISO 31000:2018 Risk Management – Guidelines.

Risk Management

Council maintains risk registers and associated controls for strategic, operational and project level risks, which are overseen by the Operational Risk Management Committee. Council follows the principles in the Australian Standard AS/NZS ISO 31000:2018 Risk Management-Guidelines.

Financial

The Policy will be implemented within existing budget and resources.

People

The Policy will be implemented within existing staffing resources.

Environmental

There are no direct environmental implications from adopting the Policy.

Social

The BCMP supports the existing Enterprise Management Risk Framework to plan, respond and recover from events that may disrupt Council operations and services to the community. The BCMP Principles #3 and #6 refers to minimising impacts and timely community communications.

Human Rights

The Policy is compatible with the Human Rights Act 2019 as it strengthens Council’s risk management framework to recover from disrupting events so that the impact on human rights and interests are minimised.

Alignment with Council's Policy and Plans

Risk Management is aligned to good governance and an Efficient and Effective Organisation.

Consultation

|

Consulted |

Consultation Date |

Comments/Actions |

|

Operational Risk Management Committee |

February 2024 |

Presented draft Policy for review. |

|

Civic Services Recovery Meeting and Councillors |

May 2024 |

Presented draft Policy for review. |

Options

Option One

That Council resolves to adopt RAL-004-P Business Continuity Management Policy as attached to this report.

Option Two

That Council resolves to seek further information and clarification at a further Councillor Briefing Session.

|

That Council resolves to adopt RAL-004-P Business Continuity Management Policy as attached to this report. |

13.6 Redheart Pty Ltd - Non Trading Company Closure

Objective Reference: A11067582

Authorising Officer: Amanda Pafumi, General Manager Organisational Services

Responsible Officer: Amanda Pafumi, General Manager Organisational Services

Report Author: Andrew Ross, Executive Group Manager Risk & Legal Services

Purpose

To wind up Redheart Pty Ltd as a non-trading company that has no continuing operational activity.

Background

In 1990 Redheart Pty Ltd was formed for the single purpose of holding a Mining Lease (ML 50010) together with Environmental Authority over the Council quarry at German Church Road Mount Cotton, so as to extract and sell mineral material, principally for bricks.

Redheart Pty Ltd ceased selling mineral material during the 2000’s and cost benefit analysis indicates that the cost of extraction and potential sale value of those minerals would mean that any activity would operate at a loss and therefore not recommended to proceed.

Redland City Council is the single member shareholder of Redheart Pty Ltd. Redheart Pty Ltd has no assets or liability and is underwritten by Council as it occupies the same quarry site. Redheart is effectively a shelf company that incurs annual administrative charges and auditing processes in accordance the Local Government Act 2009 and Corporations Act 2001.

The deregistration of Redheart Pty Ltd is an administrative process under the Corporations Act 2001 and in summary involves the Directors declaring the Council as the single shareholder agrees to the deregistration and the company is not trading and has effectively paid all liabilities with no continuing legal proceedings or liabilities. The company environmental authority was surrendered on 5 October 2023 with no continuing obligations.

The deregistration of Redheart Pty Ltd will have no operational impact on Council quarrying activities and will lead to administrative efficiencies, by reducing administrative costs and oversight.

Strategic Implications

Legislative Requirements

Redheart Pty Ltd will be wound up in accordance with the Corporations Act 2001 and reported in Council’s Annual Reporting process under the Queensland Audit office.

Risk Management

Redheart Pty Ltd directors has resolved the company is solvent and has no continuing assets or liabilities or continuing risks.

Financial

There are no material cost from the winding up of Redheart Pty Ltd.

People

There are no material people issues from the winding up of Redheart Pty Ltd.

Environmental

There are no material environmental issues from the winding up of Redheart Pty Ltd.

Social

There are no material social issues from the winding up of Redheart Pty Ltd.

Human Rights

There are no material Human rights issues from the winding up of Redheart Pty Ltd.

Alignment with Council's Policy and Plans

This report has a relationship with the following items of Council’s Our Future Redlands – A

Corporate Plan to 2026 and Beyond - Efficient and effective organisation objectives:

7.1 Improve the efficiency and effectiveness of Council’s service delivery to decrease costs, and

enhance customer experience and community outcomes.

Consultation

|

Consulted |

Consultation Date |

Comments/Actions |

|

Council Departmental Officers and Redheart Pty Ltd Board of Directors |

April 2024 |

Circulated proposed report recommendation. |

Options

Option One

That Council resolves to direct Redheart Pty Ltd directors to voluntarily deregister the company in accordance with the Corporations Act 2001.

Option Two

That Council resolves to request further information regarding the proposed deregistration of Redheart Pty Ltd.

|

That Council resolves to direct Redheart Pty Ltd directors to voluntarily deregister the company in accordance with the Corporations Act 2001. |

15 Reports from Community & Customer Services

15.1 Creative Arts Service Strategic Plan 2024-2029

Objective Reference: A8047489

Authorising Officer: Louise Rusan, General Manager Community & Customer Services

Responsible Officer: Shane Hackett, Group Manager Customer & Cultural Services

Report Author: Bradley Rush, Service Manager Creative Arts

Susan Magree, Acting Business Improvement and Support Officer

Attachments: 1. Creative Arts Service Strategic Plan 2024-2029 ⇩

Purpose

To seek Council’s endorsement of the Creative Arts Service Strategic Plan 2024-2029 as outlined in Attachment 1.

Background

The Creative Arts Service Strategic Plan 2024-2029 (Strategic Plan) provides the framework for service delivery by Council’s Creative Arts Unit.

The Strategic Plan includes services delivered by Redland Performing Arts Centre (RPAC), Redland Art Galleries (RAG), Cultural Development and through programs delivered via the Regional Arts Development Fund (RADF).

The 2032 Brisbane Olympic and Paralympic Games (the Games) offer a rare opportunity to advance arts and culture within our region. The Strategic Plan is designed to capitalise on this event while addressing immediate community and sector needs. By leveraging the global momentum of the Games, we will showcase our cultural richness and creativity, leaving a legacy that fosters community pride and engagement.

Our 10-year journey to the Games (and beyond) comprises two parts:

· Creative Arts Service Strategic Plan 2024 – 2029 – Our Place, Our Time

· Creative Arts from 2029 – 2034 – Our Place, Our Future

Our Place, Our Time is responsive to the post-COVID changed priorities of Redlands Coast communities and the creative sector and will take advantage of emerging opportunities. The Strategic Plan will be realised by building on established initiatives that have enabled a focused and strategic approach to strengthening the arts and cultural identity of our region. This work will continue the focus on maintaining and improving the city’s primary cultural assets and will inform the development of future assets and resources.

Our Place, Our Time is an informed body of work that considers our current state, whilst embracing rapidly changing models of arts and cultural program creation, delivery, and consumption.

Our Place, Our Future 2029 – 2034 will be prepared prior to 2029, based on research and learnings from Our Place, Our Time. This is the platform to build towards the Olympic and Paralympic Games, and beyond.

Over the next five years, the Creative Arts Unit will continue developing cultural experiences, and collaborations; focusing on strengthening communities and nurturing city pride.

Through strategic partnerships, engagement, and sustainable practices, we will champion the arts as a vital component of local government, enriching the lives of our residents and visitors while contributing to the overall social, economic, and cultural vitality of our city.

In 2023 RPAC hosted 402 events, programs, workshops and meetings and the RAG held 15 exhibitions and 112 events.

Issues

The Creative Arts Service Strategic Plan 2024-2029 for Redlands Coast is about activating diverse arts experiences that transcend traditional boundaries, driving innovation and sustainability, and empowering our community to be culturally vibrant and connected. At the core of the strategy is our collective network of visitors, community groups, and artists, both professional and emerging; with the Strategic Plan defining how Council can best serve and prioritise community needs through investment and resources.

The Strategic Plan is underpinned by five pillars: Engagement; Partnerships; Spaces; People; and Sustainability. It is supported by clear goals and defined actions which make sense of the work our Creative Arts Unit is already progressing and it guides new, creative, and bold ideas and plans. The pillars are further defined below.

1. Engagement - foster community connections by nurturing the engagement of artists, communities, and visitors through art.

2. Partnerships - build and maintain partnerships to extend the value and reach of Creative Arts services.

3. Spaces - activate arts services and experiences that exist in, around and outside of cultural facilities.

4. People - our people will continue to drive workforce optimisation, identifying specialised roles and plans for succession and innovation through a dynamic and imaginative environment.

5. Sustainability - embed a sustainable and scalable approach to local arts practice.

Each pillar is also supported by clear measures of success, including:

· Overall attendance at RAG, RPAC and off-site including workshop engagement programs and participation.

· The number of First Nations programs, exhibitions and performances delivered, artists supported and employed.

· Customer surveys measuring sentiment, transformation, programming interest and service improvement.

· Financial partnerships through funding, philanthropy and sponsorship; the number of programs in collaboration with community, artists, and arts companies.

· Delivery and maintenance of public art assets.

· Employee attendance at industry forums and conferences.

· Yearly financial return on investment.

· Social and economic returns.

· New digital upgrades and programs.

· The number of artist development programs, artists supported including local artists and dollar value.

Strategic Implications

Legislative Requirements

No legislative requirements.

Risk Management

The successful delivery of the Creative Arts Service Strategic Plan 2024-2029 will ensure:

· Delivery of quality creative arts services that meet community aspirations, and

· Creative Arts services are adequately resourced to meet community demands.

Financial

The implementation of the Creative Arts Service Strategic Plan 2024-2029 will primarily be undertaken within existing budget and staffing. Development of infrastructure to support the growth and delivery of services will be progressed through a combination of grants, Council’s budget, and project management approval processes.

People

The Creative Arts Unit will implement the Creative Arts Service Strategic Plan 2024-2029 with support from other parts of Council and in partnership with external partners.

Some additional temporary positions may be required to ensure the successful delivery of significant projects, which will be subject to Council’s budget and project management approval processes.

Environmental

There are no known environmental implications.

Social

Implementation of the Creative Arts Service Strategic Plan 2024-2029 will:

· Provide accessible and relevant programs and services that expand, diversify, and deepen audience engagement.

· Elevate First Nations artists and audiences through culturally informed practices.

· Tell local stories that strengthen community connectedness and City pride.

· Facilitate meaningful exchanges between artists, art and the broader community.

· Apply an evidence-based approach to programming, informed by targeted feedback and data.

· Attract increased visitation to the region through unique and exceptional cultural experiences.

Human Rights

There are no known human rights implications associated with this report.

Alignment with Council's Policy and Plans

The Creative Arts Service Strategic Plan 2024-2029 delivers on Council’s Operational Plan 2023-2024 and Our Future Redlands – A Corporate Plan to 2026 and Beyond. Specifically, this plan will contribute to:

Operational Plan 2023-2024:

· KI2.2.1 Develop and deliver initiatives to recognise and celebrate our local heritage and diverse cultures through the arts and events that promote connectivity.

b) Develop and implement the Creative Arts Service Strategic Plan 2023-2028.

c) Seek out grant funding opportunities to continue the refurbishment project for the Redland Performing Arts Centre.

Our Future Redlands – A Corporate Plan to 2026 and Beyond:

· Goal 2: Strong Communities. Key Initiative 2 – Develop and deliver initiatives to recognise and celebrate our local heritage and diverse cultures through the arts and events that promote connectivity.

· Goal 3: Quandamooka Country. Objective 3.1 – Value, engage and collaborate with Traditional Owners of much of Redlands Coast, the Quandamooka People.

· Goal 6: Thriving Economy. Objective 6.5 – Deliver activities, events, performances and experiences that bring social, cultural and economic benefits to the community.

Consultation

|

Consultation Date |

Comments/Actions |

|

|

Executive Leadership Team |

20 May 2024 |

Creative Arts play a strong role in creating the unique identity of Redlands Coast, including supporting local artists. Ensure clear, specific measures of success and develop tools and methodology to inform return on investment. |

|

General Manager Community and Customer Services |

20 March 2024 |

Alignment to Corporate and Operational Plans, timing, measures of success and simplified terminology.

|

|

Group Manager Customer and Cultural Services |

12 March 2024 |

Alignment to Corporate and Operational Plans. |

|

Service Manager Strengthening Communities |

13 May 2023 |

Provided the broader context of the Stronger Communities Strategy 2024-2027. |

|

Service Manager Facilities Services and Strategic Adviser Social Planning |

13 May 2023 |

Consulted. |

|

Principal Adviser Community Events |

13 May 2023 |

Consideration of public art trails and tourism, included in both actions and measures of success. |

|

Communication, Engagement and Tourism |

8 April 2023 |

Provided the broader context of Council’s Redlands Coast Destination Management Plan 2023-2028. |

|

Programming Manager – RPAC Community Cultural Development Officer Acting Director RAG Senior Adviser Policy and Strategy |

9 March 2023 16 March 2023 23 March 2023 |

Strategy Development Workshops were held as follows:

Workshop 1 Introduction to the Journey Workshop 2 Big Picture – Values and Future State, SWOT Workshop 3 Set Goals and Actions |

|

Quandamooka Yoolooburrabee Aboriginal Corporation Redland Museum Quandamooka Artist Reference Group Indelabilityarts Screech Arts Theatre Redlands Redlands Creative Alliance Inc Yurara Art Society |

28 June 2021 |

Survey feedback provided on three key themes: 1. Priorities for a thriving arts community in Redlands Coast. 2. Priorities for arts practice development. 3. Arts and cultural programs. |

Options

Option One

That Council resolves as follows:

1. To endorse the Creative Arts Service Strategic Plan 2024-2029 as outlined in Attachment 1.

2. To note that funding requests may be submitted for consideration as part of upcoming budget processes over the coming five years.

Option Two

That Council resolves to request further information or significant changes to the Creative Arts Service Strategic Plan 2024-2029 (Attachment 1) and for the revised document to be brought back to a future General Meeting for consideration by end July 2024.

|

That Council resolves as follows: 1. To endorse the Creative Arts Service Strategic Plan 2024-2029 as outlined in Attachment 1. 2. To note that funding requests may be submitted for consideration as part of upcoming budget processes over the coming five years. |

15.2 Adoption of RAL-003-P Boundary Fence Contribution Policy

Objective Reference: A7613354

Authorising Officer: Louise Rusan, General Manager Community & Customer Services

Responsible Officer: Graham Simpson, Group Manager Environment & Regulation

Report Author: Damien Jolley, Senior Property Officer

Attachments: 1. RAL-003-P Boundary Fence Contribution Policy ⇩

Purpose

To establish Council’s policy, in line with the Neighbourhood Disputes (Dividing Fences and Trees) Act 2011, in relation to requests from property owners for contribution to cost of a shared boundary fence by the creation of RAL-003-P Boundary Fence Contribution Policy.

Background

The Dividing Fences Act 1953 (DFA 1953) was replaced by the Neighbourhood Disputes (Dividing Fences and Trees) Act 2011 (the Act) in 2011, with a significant change being made to local governments’ responsibility for contributing to the cost of a shared boundary fence.

Under the DFA 1953, local governments were exempt from contributing to the cost of a shared boundary fence if the local government land was designated for any public purpose. As such, Council’s operational position was that it was not liable to contribute to fencing costs, regardless of the tenure, zoning or purpose of land under its ownership.

The Act re-defined ‘Owner for Land’ and as a result, Council became legislatively liable to contribute for all its freehold and leased land (that adjoins private land) unless the land is used as a ‘public park’. Council remains exempt under the Act for land held in trust on behalf of the State (Reserve land).

From 2018, Council’s Strategic Property Unit has managed shared boundary fence requests on behalf of operational areas (that are identified as an asset owner). It was noted around this time that operational areas were generally not aware that Council’s responsibility under the Act had changed.

Issues

Liability to Contribute

It is not disputed that under the Act, Council has a legislative responsibility as an owner, to contribute to the cost of a boundary fence. The Act allows for certain exemptions to this responsibility, but application of the terms used in defining those exemptions is not straightforward.

Section 14 of the Act provides an exemption to Council:

if the land is . . . used as a public park and the registered owner of the land is a local government, the local government is not an owner for the land;

A definition of the term ‘public park’ is not provided in the Act. However, a review of the Act by the Queensland Law Reform Commission (QLRC) in December 2015 suggested that a public park is “land that has the facilities expected in a park (including playground equipment etc) and is open to the public”.

The QLRC Review was completed with input from a range of stakeholders including a number of submissions from State and local government areas. Many of these submissions agreed that the exemption for local government be extended to include any land held for public or community purpose. However, the QLRC did not agree with that position, stating that other considerations such as safety or commercial reasons need to be allowed for. It also stated that the term “public park” did not need further definition.

Appropriate Management of Requests

Council has seen an increase in the number of requests from residents for Council to contribute to shared fencing costs. In instances where Council has declined this request for shared contribution, the definition of the use of the land has been questioned. Operational areas are also unfamiliar with the requirements and generally do not budget for costs associated with a shared boundary fence.

Applying the Act and QRLC’s relatively narrow interpretation of a public park significantly increases the number of potential properties where Council may have to contribute.

However, a more consistent approach can be applied that maintains the intention of the Act and provides a balanced outcome for Council and the community by ensuring a public park is defined appropriately.

For the purposes of providing clarity, a public park is recommended to be defined under Council’s Guideline as follows:

Where the freehold land has two or more of the following characteristics:

· Is a named park.

· Land use is designated as Park or Reserve.

· Zoned either Recreation and Open Space, Conservation or Environment Protection.

· Has facilities for use by the public.

· Is accessible by the public.

· Is signed as a park.

· Has walking/cycling paths.

· Provides a connection to a park.

Council’s policy position will provide residents and Council with clarity for when it may be liable to contribute. It will also improve Council’s ability to efficiently and transparently respond to adjoining owner requests.

Strategic Implications

Legislative Requirements

Neighbourhood Disputes (Dividing Fences and Trees) Act 2011 sets out the requirements in regard to dividing fences, including ownership and contribution requirements.

Risk Management

The policy will limit any potential reputational risk to Council in making decisions on whether or not to contribute to the cost of dividing fences.

Simply accepting the narrow interpretation of the definition provided under the Act (for public park) creates a potentially significant financial risk. It is important that a balanced and equitable understanding of what public park means under the Act exists to ensure consistent decision making. Current freehold land includes open space, conservation areas, developer dedicated connections and drainage areas, as well as coastal foreshore spaces.

Financial

The policy will allow operational areas to consider budgetary implications based on the type of land in their management. This is likely to be a new line item in most areas and will initially reflect the history of similar claims and the probability of claims being received from a percentage of their respective property portfolios.

People

Considerations of claims will be undertaken by the Strategic Property Unit with the current claim volume to be met within existing resources.

Environmental

No implications identified.

Social

No implications identified.

Human Rights

In accordance with section 58 of the Human Rights Act 2019, consideration has been given to the relevant human rights, in particular section 25 Privacy and Reputation, when drafting this policy.

Alignment with Council's Policy and Plans

No non-alignment identified.

Consultation

|

Consulted |

Consultation Date |

Comments/Actions |

|

Corporate Meetings & Registers Team Leader |

9 June 2023 |

|

|

Senior Solicitor Legal Services |

Various through 2022 and 2023 |

|

|

Service Managers from City Assets, Parks and Conservation, Facilities, Asset Management and Communities |

Various through 2022 and 2023 |

Property asset owners and/or have interest in Council infrastructure on land. |

Options

Option One

That Council resolves to adopt RAL-003-P Boundary Fence Contribution Policy, as attached to this report.

Option Two

That Council resolves not to adopt RAL-003-P Boundary Fence Contribution Policy.

|

That Council resolves to adopt RAL-003-P Boundary Fence Contribution Policy, as attached to this report.

|

15.3 Bayside and Redlands Transport and Mobility Study - Submission

Objective Reference: A11142569

Authorising Officer: Louise Rusan, General Manager Community & Customer Services

Responsible Officer: David Jeanes, Group Manager City Planning & Assessment

Report Author: Simon Honywood, Principal Transport Planner

Attachments: 1. Bayside and Redlands Transport and Mobility Study Project Newsletter ⇩

2. Bayside and Redlands Transport and Mobility Study - Strategic Needs ⇩

3. Bayside and Redlands Transport & Mobility Study Fact Sheet - Vision and Strategic Outcomes ⇩

4. Bayside and Redlands Transport & Mobility Study - Study Area ⇩

5. Bayside and Redlands Transport & Mobility Study Redland City Council Draft Submission ⇩

Purpose

Background

The Study is identified as a strategic project in the State Government’s Queensland Transport and Roads Investment Program. The Study commenced in late 2022-2023 and concludes in July 2024.

A Technical Working Group was established in late 2022 to advise the DTMR project team on the key challenges and opportunities, to consider potential transport options and responses to address transport needs and requirements. The Group comprises officers from Brisbane and Redland City Councils, DTMR and consultants appointed by the Department to conduct the Study.

In December 2023, the State Government approved the South East Queensland Regional Plan Update (ShapingSEQ 2023). This Plan envisaged a significantly larger population and workforce in Redland City than anticipated in ShapingSEQ 2017, with the inclusion of an urban ‘expansion area’ in Southern Thornlands and further urban consolidation in established urban areas.

The Study considers the future development pattern and the impacts this would have on the current transport network. It is anticipated that the Study will identify key transport initiatives that will serve the city in 2046, in response to urban development and growth.

Community consultation commenced on 29 April 2024 and concluded on 27 May 2024. Consultation occurred via the publication of information on the DTMR website, comprising a project newsletter and two fact sheets (Attachments 1 to 3). Responses could be made via a survey and an interactive map.

On 14 May 2024, the Director General for the Department of Transport and Main Roads agreed to allow a late submission to be made by Redland City Council (Council).

The DTMR project team will consider community consultation and Council feedback when finalising the Study. The Technical Working Group will be asked to review the Study before it is finalised and submitted to the Minister for Transport and Main Roads and Minister for Digital Services (the Minister).

A briefing will be provided to Council once the Minister has approved the Study.

Issues

Publications

The published material available to inform Council’s response comprises a project newsletter, a fact sheet addressing strategic needs and a fact sheet outlining the vision and strategic outcomes. Refer to Attachments 1 to 3. The mechanism for the community to respond was via survey and interactive map.

The published material is strategic in nature and, therefore, limiting the scope for Council to comment on initiatives that address the strategic needs and achieve strategic outcomes for the city. However, Council officers have been involved at critical stages of the project and are providing feedback to DTMR officers on all aspects of the Study.

Due to tight timelines on this project, the DTMR project team had limited scope to canvass Council feedback. The Study should be delivered in mid-2024.

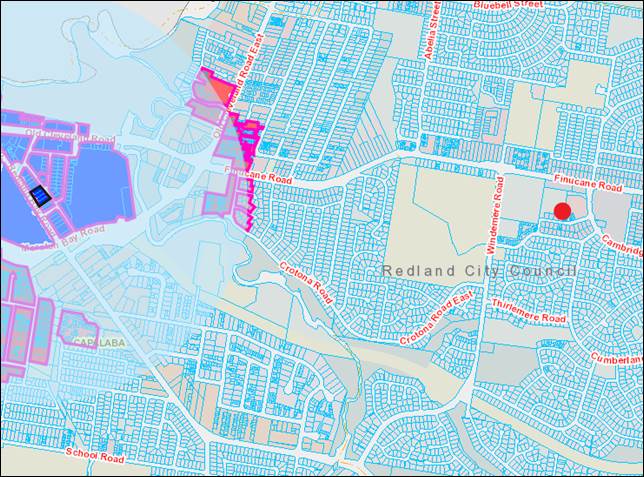

Study Area

The study area covers the Redland City mainland and part of Brisbane City east of the Gateway Motorway and south of the Brisbane River. It excludes Minjerribah, Coochiemudlo Island and the Southern Moreton Bay Islands. It also excludes the eastern tip of Logan City, where several prominent existing and proposed transport networks run from Redland City (Attachment 4).

While areas were excluded from the study area, the project team has considered impacts and needs beyond this area in their assessment of strategic needs, strategic outcomes and the vision.

Existing Transport Issues

The Study identified some current transport issues, namely:

· Approximately 91% of commuters in the study area use private vehicles.

· The average time spent travelling by public transport is roughly three (3) times more than by car and people travel twice as far.

· Walking and riding connectivity to public transport in the area is currently low.

· Some 65% of employed residents rely on the transport network to access jobs outside of the Study area.

Transport Needs Arising from Growth

DTMR advises that the study area could accommodate some 74,500 additional residents by 2046, of which a significant proportion could be located in Southern Thornlands and through urban consolidation in Redland City. This, combined with existing travel demand, will significantly impact the transport system, as identified by the following strategic transport and mobility needs:

· Improved walking, cycling, and public and passenger transport options to, from and within key centres in the area (such as Cleveland, Capalaba and Wynnum).

· High quality, safe cycling connections between these centres and major attractions.

· Safer roads and roadsides, which accommodate growth in demand, especially on key road corridors.

· Transport systems are enhanced to support planned population growth in a sustainable way.

The Study identifies that addressing these strategic matters will ‘…balance the needs and safety of the community and all transport users.’

The Transport Vision

The transport vision being put forward in the Study is similar to that espoused in Council’s Redlands Coast Transport Strategy and is also intended to ‘safeguard place characteristics in our centres’.

Strategic Outcomes

The strategic outcomes being sought by the Study are largely consistent with those outlined in the Redlands Coast Transport Strategy, but also include enhanced connectivity to the Port of Brisbane (in Brisbane City).

Matters to Address in the Final Study

Council has identified matters that it requests be addressed in the final Study – refer to Attachment 5 for a draft submission.

Strategic Implications

Council has identified a number of matters that it requests be addressed in the final Study approved by the Minister. These are detailed in Attachment 5.

Legislative Requirements

There is no legislative requirement to undertake the Study. However, such studies are critical in assisting state and local governments to identify infrastructure and non-infrastructure solutions, many of which can be captured in Local Government Infrastructure Plans. These studies also enable governments to identify initiatives requiring both capital and operational budget investments that support the city’s economic, employment and population growth.

Risk Management

DTMR’s consultation approach could have resulted in adverse reactions from the community due to the limited information that was available to provide meaningful feedback. Alternatively, providing more detail can create uncertainty, especially when individuals feel their properties could be adversely impacted by transport initiatives. On the other hand, providing examples of initiatives linked to strategic outcomes can make such studies more tangible for the community.

The community may confuse the Study as a Council project, whereas it has been neither prepared for nor endorsed by Council. Council officers have prepared messaging that clarifies this as a State Government project should there be any media reaction or enquiries.

Financial

Council has not been asked to endorse the Study by the Minister. As such, there are no direct financial implications for Council. Conversely, there could be substantial benefits for the city, bearing in mind that the State government owns and manages much of the strategic road network and is responsible for delivering public transport. Such a Study can assist in securing funding by the Federal and State governments for capital projects.

The Study outcomes could guide Council’s transport planning and delivery programs and will inform a review of the Redlands Coast Transport Strategy. Ultimately, Council’s strategy could identify initiatives requiring Council capital and operational expenditure. These initiatives will be subject to funding through Council’s annual budget process.

People

The Study has no immediate implications for further staffing. Council officers have been providing advice to DTMR as part of their core business functions.

Environmental

While urban, economic and employment growth have environmental impacts, the intent of the Study is to facilitate more sustainable travel and the development of transport networks that support this.

Social

The Study proposes a greater emphasis on active, public and passenger transport which, potentially will provide a greater range of travel choices than is currently the case, which particularly supports those with limited travel options.

Human Rights

A role for local government is to ensure that the community has equitable access to education, employment, health and capacity to participate in public life and public office. The transport network plays a pivotal role in ensuring that the public can access these opportunities. In addition, Council continues to advocate for transport outcomes that support greater access to the city and region’s economic, social and employment opportunities.

Alignment with Council's Policy and Plans

The Study’s vision and strategic outcomes are largely congruent with those espoused by Council, in its Corporate Plan and the Redlands Coast Transport Strategy 2020.

Consultation

|

Consulted |